Marvell Technology (MRVL): A Smart Buy or a Risky Hold? Expert Insights for Q1 2025

Navigating the Semiconductor Landscape: A Look at Marvell Technology (MRVL)

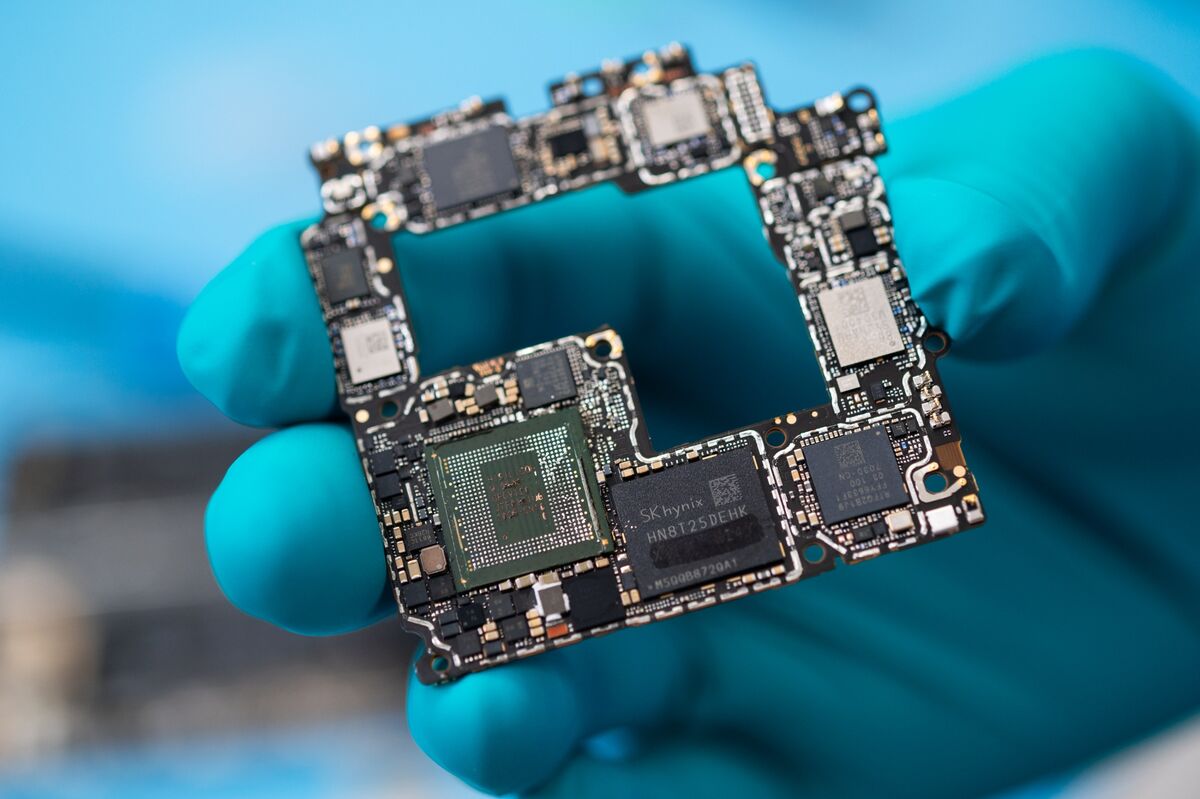

The semiconductor industry is a dynamic and complex space, constantly evolving with technological advancements and shifting market demands. As investors, it's crucial to stay informed and analyze companies within this sector to make sound investment decisions. One such company garnering attention is Marvell Technology (MRVL), a provider of data infrastructure solutions. Recently, Columbia Threadneedle Investments, a leading investment management firm, shared insights into their “Columbia Threadneedle Global Technology Growth Strategy” first-quarter 2025 investor letter, offering valuable perspectives on MRVL’s performance and potential.

Columbia Threadneedle's Perspective: A Positive Outlook

Columbia Threadneedle's assessment of Marvell Technology appears largely positive. While the specifics of their commentary aren't fully detailed in public releases, their inclusion of MRVL within their Global Technology Growth Strategy suggests a belief in the company's long-term growth prospects. This strategy typically focuses on companies poised to benefit from disruptive technologies and secular growth trends. Therefore, their investment signals a conviction that Marvell is well-positioned to capitalize on these opportunities.

Why Marvell Technology Matters: Key Strengths and Drivers

To understand why Columbia Threadneedle might be bullish on MRVL, it's important to consider the company's core strengths and the factors driving its growth:

- Data Infrastructure Expertise: Marvell specializes in data infrastructure solutions, which are essential for the modern digital world. As data volumes continue to explode, the demand for high-performance data processing and connectivity will only increase.

- Strong Position in Key Markets: Marvell holds a significant presence in key markets such as data centers, 5G infrastructure, and automotive. These sectors are experiencing robust growth, providing a favorable backdrop for the company's expansion.

- Strategic Acquisitions: Marvell has demonstrated a history of making strategic acquisitions to broaden its product portfolio and expand its market reach. These acquisitions have proven to be accretive to earnings and have strengthened its competitive position.

- Focus on Innovation: The company invests heavily in research and development, constantly innovating to meet the evolving needs of its customers. This commitment to innovation is crucial for maintaining a competitive edge in the rapidly changing semiconductor industry.

Risks to Consider: Navigating Potential Challenges

While the outlook for Marvell Technology appears promising, investors should also be aware of potential risks:

- Cyclical Nature of the Semiconductor Industry: The semiconductor industry is inherently cyclical, and downturns can impact demand and pricing.

- Competition: Marvell faces intense competition from other established players in the semiconductor space.

- Geopolitical Risks: Global trade tensions and geopolitical uncertainties can disrupt supply chains and impact business operations.

- Macroeconomic Conditions: Economic slowdowns can negatively impact overall technology spending, affecting Marvell’s revenue growth.

Should You Hold Marvell Technology (MRVL)?

Based on Columbia Threadneedle's positive inclusion in their growth strategy and Marvell's underlying strengths, a “hold” or even a “buy” rating could be justifiable for long-term investors. However, it's crucial to carefully weigh the risks and conduct thorough due diligence before making any investment decisions. Monitor the company's performance, industry trends, and macroeconomic conditions to ensure your investment strategy remains aligned with your financial goals. Keep an eye on upcoming earnings reports and analyst commentary for further insights into Marvell's prospects in the coming quarters.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.