Credo Technology: Riding the Data Center Boom - Is the Stock Price Justified?

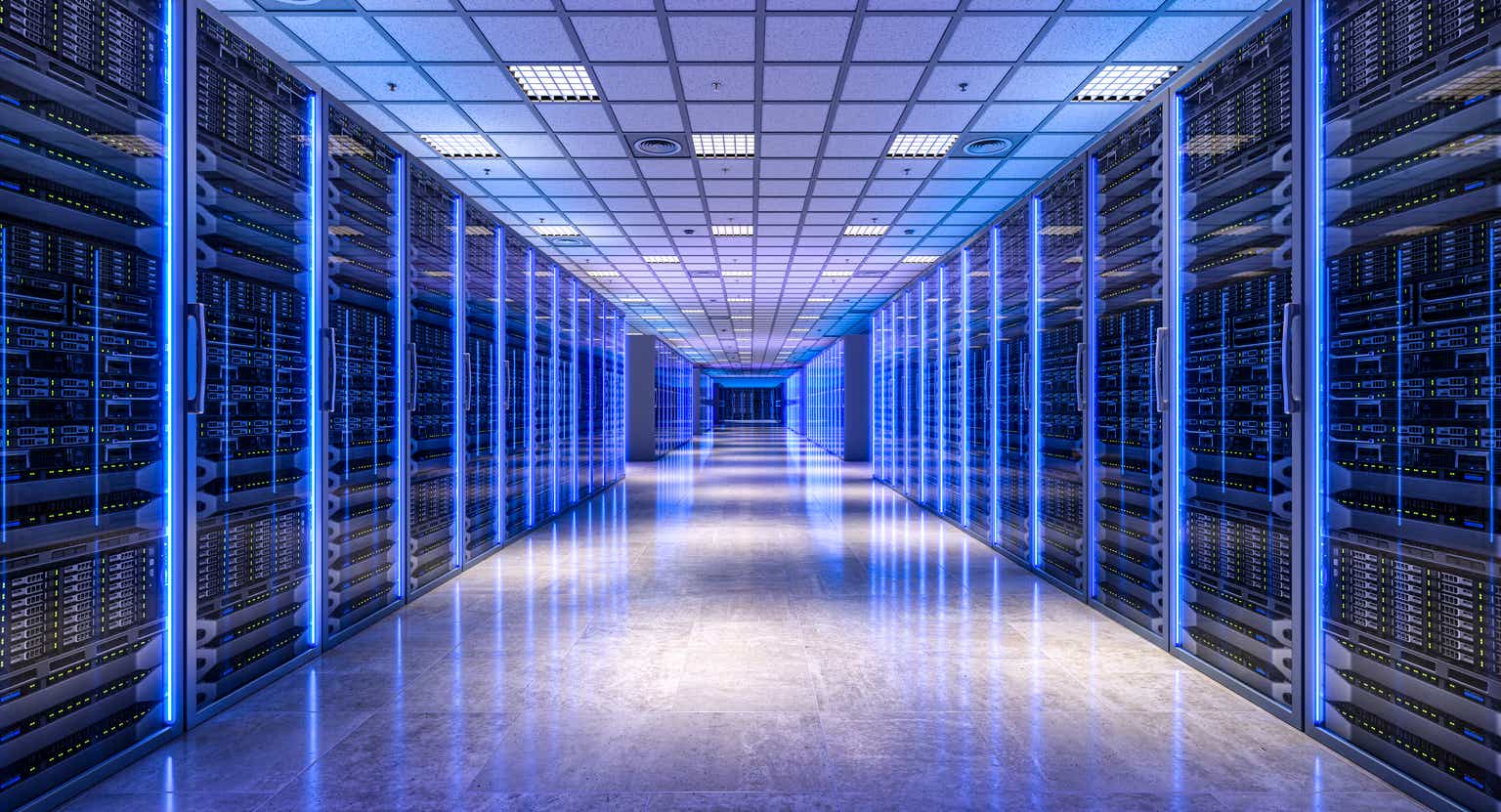

Credo Technology (CRDO) has rapidly emerged as a key player in the burgeoning data center interconnect (DCI) market. Fueled by the relentless growth of cloud computing, AI, and 5G, the demand for high-speed connectivity within and between data centers is skyrocketing. Credo is strategically positioned to capitalize on this trend, delivering impressive revenue growth and innovative solutions.

The Data Center Interconnect Opportunity: A Massive Tailwind

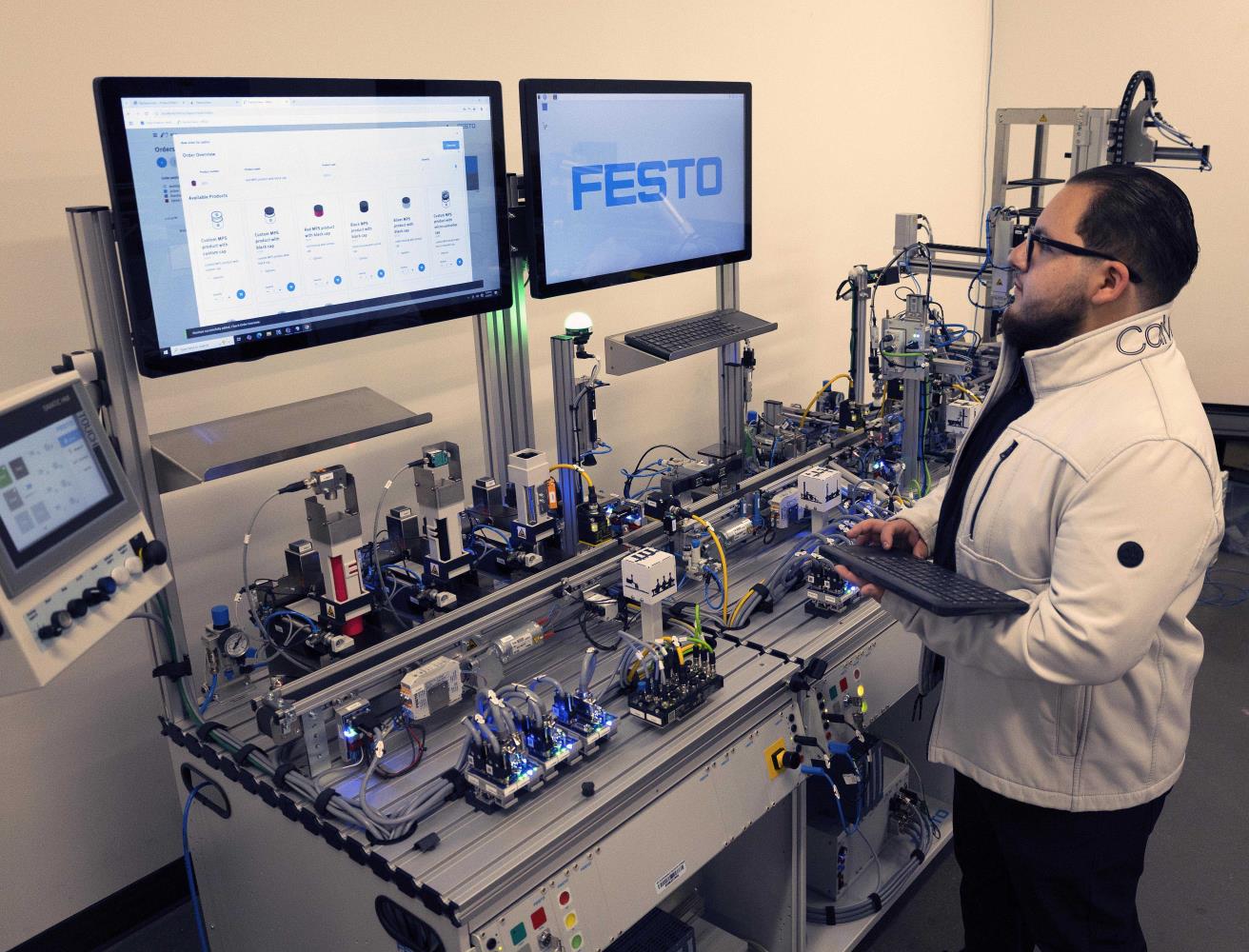

Let's start with the macro picture. Data centers are the backbone of the digital economy, and they're expanding at an unprecedented rate. The explosion of data generated by connected devices, streaming services, and enterprise applications necessitates increasingly robust and efficient data transfer capabilities. DCI solutions, which facilitate high-bandwidth connections between data centers, are crucial for meeting this demand.

Credo's focus on optical and electrical interconnect solutions directly addresses this critical need. They offer a comprehensive portfolio of products, including transceivers, cables, and active optical cables (AOCs), designed to support the latest high-speed networking standards like 400G, 800G, and beyond.

Credo's Strengths: Innovation and Customer Relationships

What sets Credo apart from its competitors? Several factors contribute to their success:

- Technological Innovation: Credo consistently invests in R&D, pushing the boundaries of interconnect technology. Their focus on silicon photonics gives them a competitive edge in terms of performance and cost-effectiveness.

- Strong Customer Relationships: Credo has secured partnerships with leading hyperscale cloud providers, networking equipment manufacturers, and telecommunications companies. These relationships provide a stable revenue stream and valuable feedback for product development.

- Rapid Revenue Growth: Credo's revenue growth has been impressive, reflecting the strong demand for their products and their ability to execute on their strategy.

The Valuation Question: A Premium for Growth

However, this impressive growth comes at a price. Credo's stock valuation is currently high, reflecting the market's anticipation of continued rapid growth. The question is whether this growth can be sustained, and whether the current valuation is justified.

Our valuation assessment takes into account several factors, including:

- Projected Revenue Growth: We've modeled various growth scenarios, considering the potential impact of macroeconomic factors and competitive pressures.

- Profitability: While Credo has been investing heavily in growth, we expect to see improved profitability as the company scales.

- Competitive Landscape: The DCI market is becoming increasingly competitive, with established players and emerging startups vying for market share.

Conclusion: A Risky but Potentially Rewarding Investment

Credo Technology presents a compelling story – a company riding the wave of the data center boom with innovative technology and strong customer relationships. However, the demanding valuation introduces a significant level of risk. Investors should carefully consider their risk tolerance and conduct thorough due diligence before investing in CRDO stock. While the potential rewards are significant, a correction in the stock price is certainly possible if growth expectations are not met. Monitoring their key customer relationships and technological advancements will be crucial for assessing the long-term viability of the investment.