Twiggy's Green Hydrogen Gamble: A Costly Lesson for Australia?

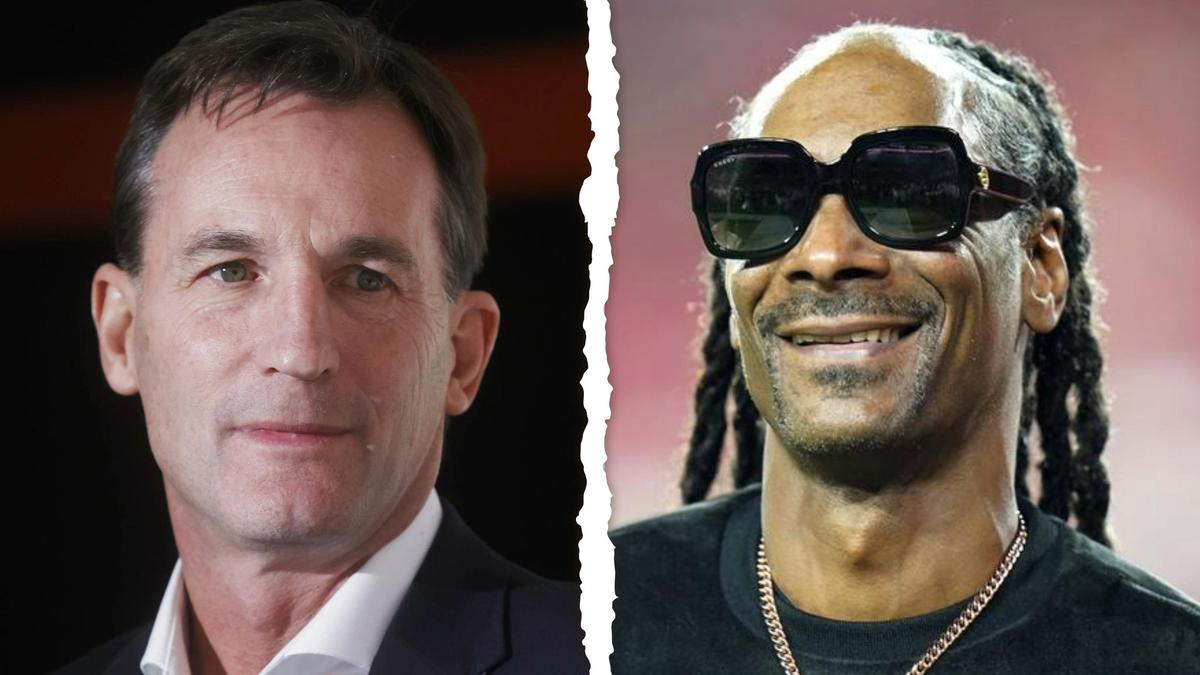

Andrew Forrest, the billionaire mining magnate known as “Twiggy,” championed green hydrogen as Australia’s next economic boom. The vision was ambitious: harnessing the power of water to produce limitless, clean energy, transforming Australia into a global hydrogen superpower. But the dream appears to be fading, with projects struggling to achieve commercial viability and taxpayers footing a significant bill.

For years, Forrest aggressively lobbied governments at both the state and federal levels, securing substantial funding and incentives to support green hydrogen initiatives. His company, Fortescue Future Industries (FFI), spearheaded numerous projects, aiming to produce hydrogen through electrolysis – splitting water into hydrogen and oxygen using renewable energy. The promise was compelling: a sustainable fuel source to power industries, transport, and even homes, while drastically reducing carbon emissions.

However, the reality has proven far more challenging. The cost of producing green hydrogen remains stubbornly high, significantly more expensive than fossil fuel-based alternatives like grey hydrogen (produced from natural gas). Technological hurdles, supply chain bottlenecks, and fluctuating renewable energy costs have all contributed to the difficulties. Several large-scale projects have been scaled back or abandoned altogether, leaving governments questioning the value of their investments.

The financial implications are substantial. Billions of dollars in taxpayer funds have been allocated to support green hydrogen development, and there's growing concern that much of this money may not yield the promised returns. While Forrest has now pledged to repay public funds linked to unsuccessful projects, the episode has raised serious questions about the due diligence process and the risks associated with backing nascent technologies.

“We’ve got to be realistic about the challenges,” says Dr. Emily Carter, an energy policy expert at the University of Melbourne. “Green hydrogen has enormous potential, but it’s not a silver bullet. We need a more measured approach, focusing on targeted investments in areas where it can realistically compete and deliver tangible benefits.”

The situation highlights the complexities of transitioning to a clean energy future. While renewable hydrogen undoubtedly has a role to play, its widespread adoption requires significant technological advancements, cost reductions, and supportive policy frameworks. The Twiggy saga serves as a cautionary tale, demonstrating the importance of careful planning, rigorous evaluation, and a willingness to adapt as the energy landscape evolves. Australia's hydrogen ambitions aren't dead, but they need a serious recalibration.

The focus now shifts to identifying niche applications where green hydrogen can thrive, such as heavy industry and long-distance transport, and developing strategies to drive down production costs. The future of Australia's hydrogen dream hinges on a more pragmatic and evidence-based approach.